TD Bank - CSR Platform

Strategy and product design for a ground up redesign of TD Bank’s Customer Service Platform.

Due to a fragmented mix of outdated applications, TD’s Customer Service Representatives (CSRs) faced inefficiencies when completing tasks like deposits, account openings, and wire transfers. This disjointed system not only frustrated staff but also resulted in longer wait times for customers.

I led a team that redesigned this platform, creating a modern, integrated system that streamlined workflows, enhanced CSR productivity, and improved overall customer satisfaction.

My Role: Principal Strategist and Design Lead

Process

Current State Journey Mapping

We conducted contextual inquiry and user interviews to understand CSRs workflows and identified which pain points were most important to solve.

Co-design Workshops

We ran virtual workshops with cross-functional stakeholders and CSRs to cast a wide net around solution ideas.

Low Fidelity Prototyping

Focusing on solution concepts, we quickly prototyped our hypotheses to flesh them out and build alignment.

Iterative Testing

Within weeks of prototyping, we conducted rapid evaluative research to learn about our hypotheses.

Solution Highlights

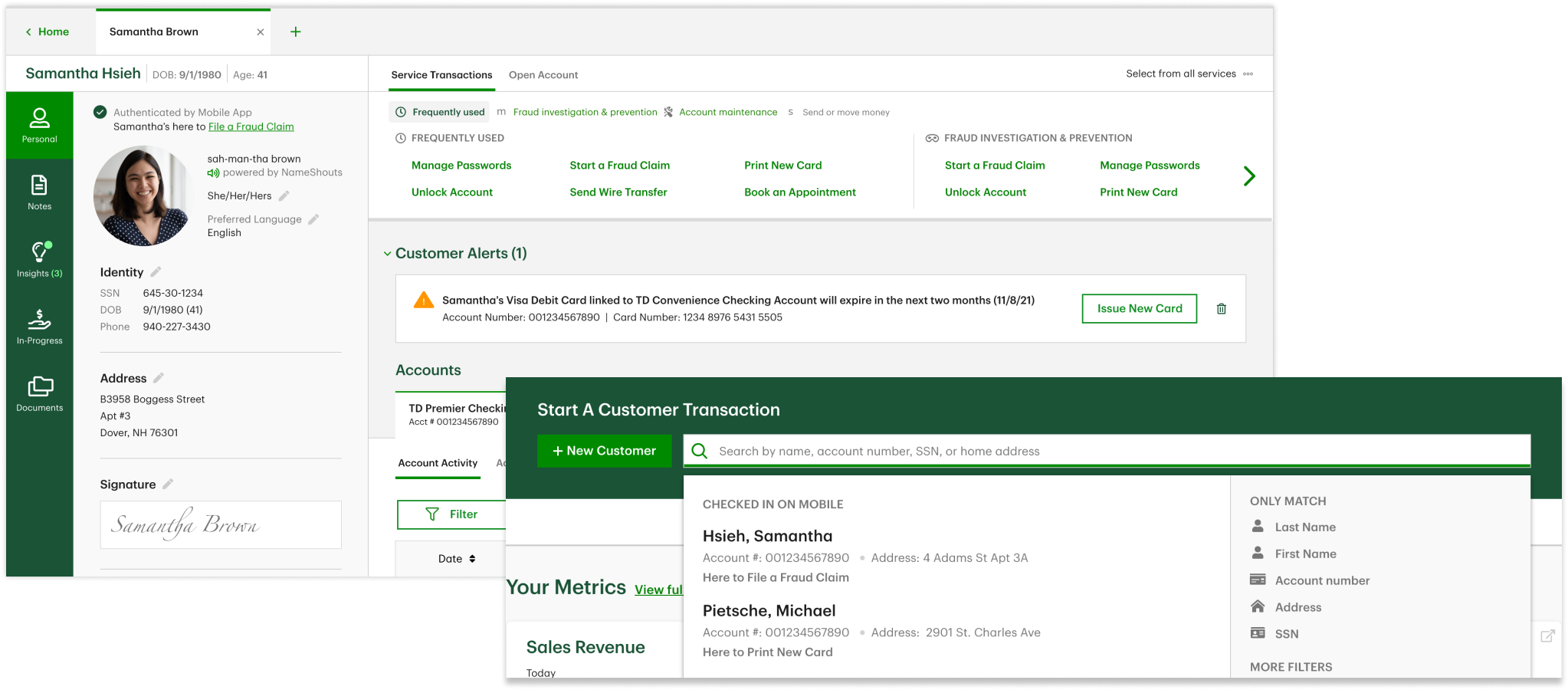

Customer Centric Profile

Problem

Prior to our redesign, Customer Service Reps (CSRs) were required to navigate to multiple platforms to see customer data and complete transactions for them. This setup required extensive knowledge and effort from CSRs to know where to look, navigate to the right place and pull together all the data needed to accomplish a task.

Solution

Because each session centered on serving a customer, we created a customer profile that consolidated and organized all of their information and offered quick access to the most frequent transactions CSRs were likely to perform for them. We also created a flexible search to make it easy for CSRs to find customers with any identifying information they had about them.

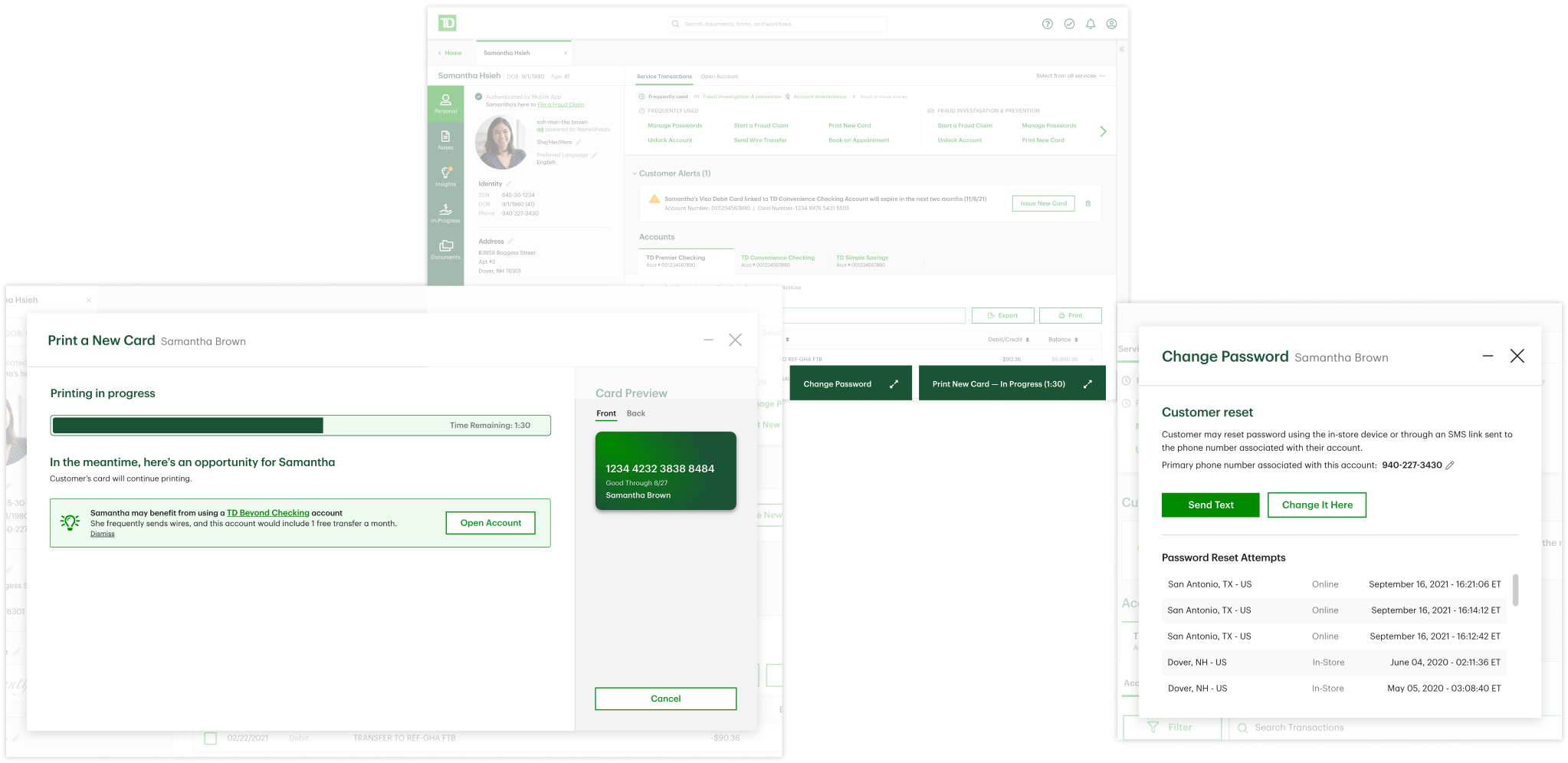

Contextual Insights

Problem

It’s difficult for Customer Service Reps to quickly identify relevant product upsell opportunities because data is fragmented and they have to apply their own set of logic to identify product gaps- taking time and effort leading and lengthening customer sessions. In the absence of this time, recommendations for new products were often too generic, which felt like a nuisance to customers.

Solution

Our solution did the work for Customer Service Reps by looking across customer data to identify targeted insights about relevant products the customers may be missing. Our approach surfaced the insights at the right point in the transaction so it feels like a natural part of the conversation.

Multitasking to Reduce Downtime

Problem

The current system only allowed CSRs to perform transactions on one customer at a time. This was too limiting for real world use as some transactions took time to process (ex: printing a new debit card) and created down time that could be used to accomplish tasks for other customers.

Solution

We designed a way for CSRs to better fill this downtime by enabling them to work on multiple transactions at once- enabling them to quickly move from one transaction to another while keeping a primary customer in focus.